The Impact of Technology on Modern Share CFD Trading Practices

CFD Trading

Technology has profoundly transformed Share CFD Trading, reshaping the way traders access markets, execute strategies, and manage risks. Advancements ranging from real-time data analytics to AI-driven automation have made trading more accessible, efficient, and dynamic. This evolution has democratized market participation, allowing traders of all levels to compete effectively. Let's explore how technology is revolutionizing modern Share CFD trading practices and how traders can leverage these innovations to stay competitive.

Seamless Market Access

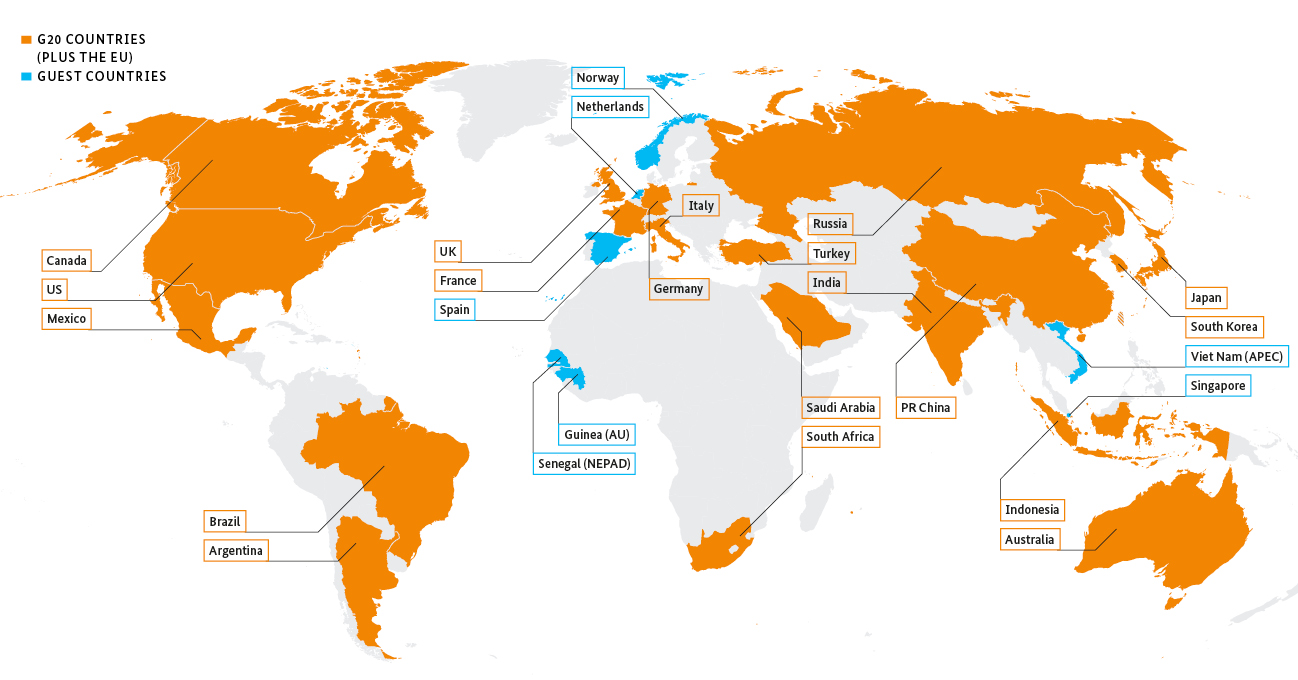

One of the most significant impacts of technology is the democratization of market access. Advanced trading platforms now enable traders to connect to global markets from anywhere at any time. These platforms offer multi-market trading, providing access to shares from different regions, industries, and sectors. With cross-device synchronization, traders can monitor and execute trades on mobile devices, desktops, or web-based platforms, ensuring they never miss an opportunity. Moreover, technology has reduced transaction costs, enabling traders with smaller capital to participate effectively. This level of accessibility empowers retail traders to compete alongside institutional investors, breaking down barriers that once limited market participation.

Real-Time Data and Analysis

Modern Share CFD trading relies heavily on accurate and timely information. Technology delivers real-time data feeds, empowering traders to make informed decisions with up-to-the-minute insights. Market data feeds provide live price updates, order book details, and market depth, allowing traders to respond quickly to changing market conditions. Integrated technical analysis tools, such as moving averages, Bollinger Bands, and Fibonacci retracements, simplify complex analysis directly within trading platforms. Additionally, AI-driven tools perform sentiment analysis by scanning news, social media, and market trends to gauge investor sentiment, providing a competitive edge in predicting market moves. These tools eliminate guesswork, enabling traders to make data-driven decisions.

Automation and Algorithmic Trading

Automation has revolutionized Share CFD Trading, enabling traders to execute strategies with precision and efficiency. Algorithmic trading allows programs to execute trades based on predefined criteria, such as price movements or volume thresholds, eliminating emotional decision-making and ensuring consistency. AI-driven bots utilize machine learning algorithms to analyze data, identify patterns, and adapt strategies in real-time, processing vast datasets at lightning speed. Furthermore, automated risk management tools adjust stop-loss orders, position sizes, and leverage levels dynamically, protecting traders from unexpected market moves. For traders, automation reduces the time spent monitoring markets and increases the potential for consistent results.

Enhanced Risk Management

Risk management is critical in Share CFD Trading, and technology has introduced sophisticated tools to minimize exposure and protect capital. Dynamic stop-loss and take-profit orders enable traders to set trailing stops and limit orders that adjust with market movements. Integrated portfolio analysis tools evaluate performance and identify overexposed positions, helping traders maintain balanced risk. Real-time leverage monitoring provides insights into margin usage, ensuring traders avoid over-leveraging. These features give traders greater control and confidence, particularly in volatile markets.

The Rise of Mobile Trading

Mobile technology has brought trading to the palms of traders' hands. Mobile apps provide full access to trading platforms, allowing users to monitor markets in real-time, execute trades instantly, and receive push notifications for market alerts or triggered orders. This mobility ensures that traders can stay connected to the markets, even when they are on the go, enhancing their responsiveness and efficiency.

Artificial Intelligence and Predictive Analytics

AI and predictive analytics are shaping the future of Share CFD trading by delivering deeper market insights and automating decision-making. AI technologies identify price patterns and predict potential breakouts or reversals through pattern recognition. Machine learning algorithms adapt to individual trading styles, offering customized insights and recommendations. Event impact analysis uses AI to evaluate the potential impact of news events or economic data on specific shares, enabling traders to anticipate market reactions. These capabilities provide a significant advantage in a competitive trading environment.

Social and Copy Trading

Technology has enabled social and copy trading, allowing beginners to learn from and replicate the strategies of experienced traders. Social platforms facilitate the sharing of insights, strategies, and market updates in real-time, fostering a collaborative learning environment. Copy trading allows novice traders to mirror the trades of successful investors, benefiting from their expertise while developing their own skills. This approach reduces the learning curve for new traders and promotes community engagement.

Leveraging Technology for Success

The integration of technology into Share CFD Trading has made the market more accessible, efficient, and data-driven than ever before. Traders who embrace these innovations while maintaining a disciplined approach can capitalize on opportunities and manage risks effectively. As technology evolves, those who adapt and leverage its potential will be best positioned to thrive in the fast-changing world of CFD trading.

What's Your Reaction?