Solana Volume: Understanding Its Impact on the Blockchain Ecosystem

Solana has emerged as one of the fastest and most scalable blockchain networks in the cryptocurrency space. With its high throughput, low transaction fees, and growing ecosystem of decentralized applications (dApps), Solana has attracted significant interest from traders, developers, and investors alike.

Solana has emerged as one of the fastest and most scalable blockchain networks in the cryptocurrency space. With its high throughput, low transaction fees, and growing ecosystem of decentralized applications (dApps), Solana has attracted significant interest from traders, developers, and investors alike. One crucial metric that plays a vital role in assessing the network's health and adoption is Solana volume. This article explores what Solana volume is, why it matters, and how it affects the broader blockchain and cryptocurrency market.

What is Solana Volume?

Solana volume refers to the total value of transactions processed within the Solana network over a specific period. This volume can be measured in different ways, including:

Trading Volume: The total amount of Solana (SOL) tokens traded across various exchanges.

On-Chain Transaction Volume: The total value of transactions occurring on the Solana blockchain, including peer-to-peer transfers, smart contract executions, and NFT transactions.

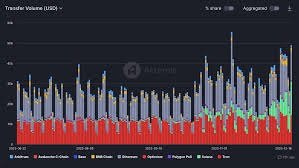

DeFi Volume: The volume of assets being traded or staked in Solana’s decentralized finance (DeFi) applications.

Understanding these different types of volume provides insights into network activity, liquidity, and overall adoption.

Importance of Solana Volume

Indicator of Market Activity

High Solana volume suggests increased market activity, indicating that traders and investors are actively engaging with the token. A surge in trading volume often reflects growing interest, which can lead to price movements and market trends.

Liquidity and Price Stability

Liquidity is crucial for any cryptocurrency, and high trading volume on Solana means that buyers and sellers can trade SOL with minimal price slippage. A liquid market ensures that large trades can be executed without significantly impacting the asset’s price.

Network Utilization

Beyond trading, Solana’s on-chain transaction volume helps assess the network’s real-world usage. Higher transaction volume suggests that dApps, NFTs, and smart contracts are being actively used, which is a positive sign for the ecosystem’s growth.

Adoption of Solana in DeFi and NFTs

Solana has gained popularity in DeFi and NFT markets due to its high-speed transactions and low costs. Increased volume in these areas indicates growing adoption and developer interest, reinforcing Solana’s position as a leading blockchain.

Factors Affecting Solana Volume

Market Trends and Sentiment

Like other cryptocurrencies, Solana’s volume fluctuates based on market conditions, investor sentiment, and macroeconomic factors such as inflation, regulations, and institutional adoption.

Network Upgrades and Development

Innovations such as new smart contracts, DeFi protocols, and NFT marketplaces can drive volume by attracting more users and transactions to the network.

Partnerships and Integrations

Collaborations with major companies and blockchain projects can boost Solana’s volume by expanding its utility and increasing its user base.

Regulatory Developments

Government policies and regulations on cryptocurrencies can impact trading behavior and on-chain volume. Positive regulations often drive adoption, while restrictive policies may hinder growth.

How to Track Solana Volume

Several platforms provide real-time data on Solana’s trading and on-chain volume. Some popular tools include:

· CoinMarketCap: Offers real-time Solana trading volume and price analysis.

· CoinGecko: Provides historical data, trading pairs, and volume metrics.

· Solscan: A blockchain explorer for tracking on-chain transactions.

· Dune Analytics: Offers insights into Solana’s DeFi and NFT activity.

FAQs

1. Why is Solana volume important for traders?

Solana volume helps traders assess market activity, liquidity, and potential price movements, aiding in better trading decisions.

2. Does high Solana volume always mean price increases?

Not necessarily. High volume indicates strong activity but does not always lead to price increases. It can also mean increased selling pressure.

3. How does Solana’s volume compare to Ethereum’s?

Solana generally has lower trading volume than Ethereum but offers faster transactions and lower fees, making it attractive for high-frequency trading and DeFi applications.

4. What causes sudden spikes in Solana volume?

Factors such as major partnerships, new dApp launches, positive news, and overall market sentiment can cause sudden increases in volume.

5. Can Solana maintain its high transaction volume in the future?

Solana’s scalability and ongoing development suggest that it can sustain high transaction volumes, but competition and market conditions will play a crucial role.

Conclusion

Solana volume serves as a key indicator of the blockchain’s activity, liquidity, and adoption. Whether through trading, DeFi, or NFT transactions, a high volume reflects increased engagement with the network. Understanding the factors influencing Solana’s volume can help traders, developers, and investors make informed decisions in the ever-evolving cryptocurrency market. As Solana continues to innovate and expand, monitoring its volume trends will be essential in assessing its long-term viability and impact on the blockchain ecosystem.

What's Your Reaction?